In the run-up to the start of the school year, BDO Corporate Finance has carried out a comprehensive study exploring the characteristics, dynamics and opportunities of the Hungarian private education market. This is the first publication of BDO Corporate Finance to examine the private education sector and aims to provide a comprehensive overview of this dynamic and growing market. Our ambition is to produce a similar analysis every year, involving experts, which not only looks at the current state and trends of the market, but also tracks changes over the long term.

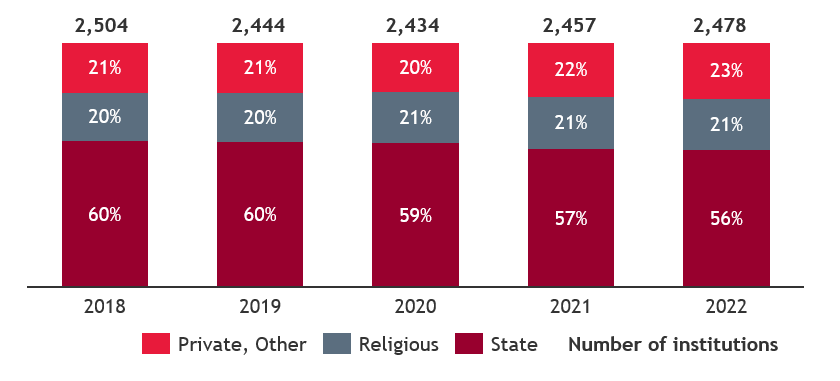

The number of students attending private schools increased from 59,000 to 64,000 between 2020 and 2023, so the importance of private education institutions increased during this period, with 23% of secondary education institutions in Hungary being either foundation-run or private in the academic year 2022-2023. The average annual revenue of organisations operating Hungarian schools is HUF 767 million, while international institutions have a higher average annual revenue of more than HUF 1 billion – according to a study by BDO Corporate Finance.

Figure 1: Distribution of secondary education institutions by type of operator (%)

Figure 1: Distribution of secondary education institutions by type of operator (%)

In recent years, the market for private schools in Hungary has developed dynamically, to the extent that institutions are unable to meet the growing demand. More and more private schools have become saturated, with longer waiting lists. This trend is further strengthened by the infrastructural development of private educational institutions, their readiness in the field of digitalisation and the continuous increase in demand for modern pedagogical methods.

In a detailed market analysis, the team of BDO Corporate Finance surveyed 28 educational institutions in the Hungarian private school market, of which 10 were identified as Hungarian and 18 as international. 46% of the institutions surveyed, i.e. 13 institutions, provide education for pupils from kindergarten to upper secondary school (3-18 years old), while 10 institutions serve primary and upper secondary school age groups and 5 institutions focus exclusively on upper secondary school pupils.

Increasing demand for private education

Several new private schools have been established in Hungary in recent years. According to information provided by the Association of Foundation and Private Schools (Hungarian abbreviation: AME), more than 20 new foundation and private schools have started operating in the country since 2018. Among the new institutions is the Diákszempont Primary School and Secondary School in Budapest (2019), but several Budapest School micro-schools have also opened (in Solymár in 2018, in Érd in 2020) in Pest county. In addition, several existing institutions are planning to expand their capacities or are even considering the creation of new campuses.

Private education generates substantial revenue

There is considerable variation in tuition fees between the institutions surveyed. For international institutions, the average annual tuition fees are HUF 4.3 million, while for Hungarian institutions the average is HUF 1.5 million. There is also a significant difference between international schools: the top two international private schools (AISB – American International School of Budapest and BISB – The British International School Budapest) have fees of up to HUF 9 million for the top year.

In terms of the institutions surveyed, the average annual revenue of organisations operating Hungarian schools is HUF 767 million, while that of international institutions is higher, at over HUF 1 billion. The largest international schools also stand out in terms of student numbers and sales turnover. For the schools surveyed, international private institutions on average generate higher revenues with a lower number of students.

Possible directions for the development of private education

As regards private institutions, the survey shows that, overall, market players can expect a steady and very strong increase in demand. Market players need to respond to this steadily growing demand, which offers investment opportunities for both existing and new market players.

The team of BDO Corporate Finance can combine financial and educational expertise to provide a wide range of support during market entry (whether setting up a new institution or acquiring and developing an existing one). For more information and to download the study, please fill out our form.

Please fill out the form to access the report!